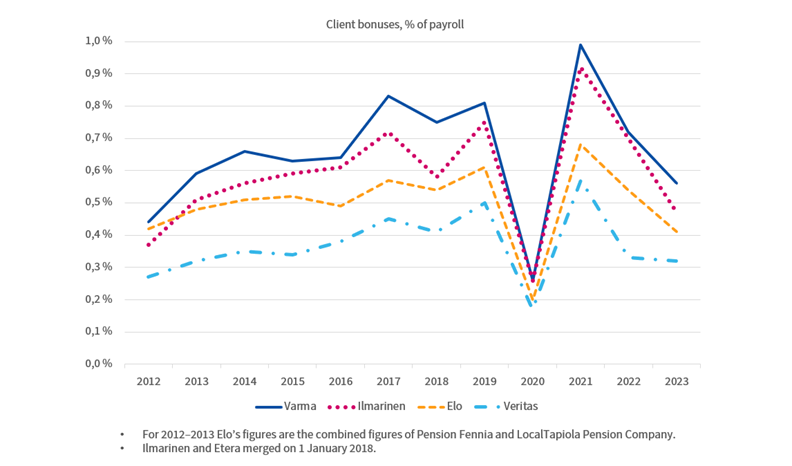

Client bonuses lower your insurance contributions

The client bonus is an annual discount in insurance contributions. In 2025, we distributed EUR 170 million in client bonuses to our customers. Client bonuses are usually allocated as a discount on the next insurance contribution invoice. If you wish, we can also deposit the client bonus into your company’s bank account. For a refund, please enter the account number in Varma Online Service: Insurance policies > Insurance policy information > Use of client bonus and extra payments > Edit.

View your client bonuses in Varma Online Service

All customers who have taken out a TyEL insurance policy with Varma benefit from client bonuses right from the start of their customer relationship. The longer an insurance policy is valid at Varma and the more wages are paid, the higher your client bonus will be. It pays to be a long-term customer of Varma.